Salary Slip: Format, Components, Deductions, Download Salary Slip in Excel & Word

A salary slip is a detailed document that contains the information about the salary that you receive from the organization that you work for. It also has the employment details including the name of the company, your designation, date of joining and other similar information. All organization issues pay Slip monthly, and it is shared with the employee in either a digital format or in a hard copy.

Who Gets a Salary Slip?

Like we mentioned above, any person working for an organization gets the salary slip. It is the responsibility of the employer to provide the salary slip to the employee. You may come across smaller organizations who do not provide salary slip to the employee regularly. Still, in such a case, you can request the company to issue you a salary certificate. Most of the companies have adopted a digital approach where they provide you with a digital version of salary slip.

Format of Salary Slip

The format of the salary slip can vary from one company to another. There are still some details that remain the same. You can find this information in the points below.

- The salary slip should contain the name of the organization along with their logo, address, and contact number.

- The salary slip should have an issue date along with the details of working days, leaves and non-working days.

- The salary slip should have employee information like the name, designation, department, employee code, PAN Number, Aadhaar Number, UAN Number, PF Number and Bank Account Number.

- The salary slip should have the details of earnings, which are segregated as per the category of the earning. For example, this will have different components like HRA, Basic Salary, Overtime Allowance, etc.

- The salary slip should also have the details of deductions which includes TDS deduction, Professional Tax, PF Contribution, etc.

- Lastly, the salary slip should have net pay, which is equal to the earnings minus deductions.

Also Read: 5 Best SIP Plan to Invest in India

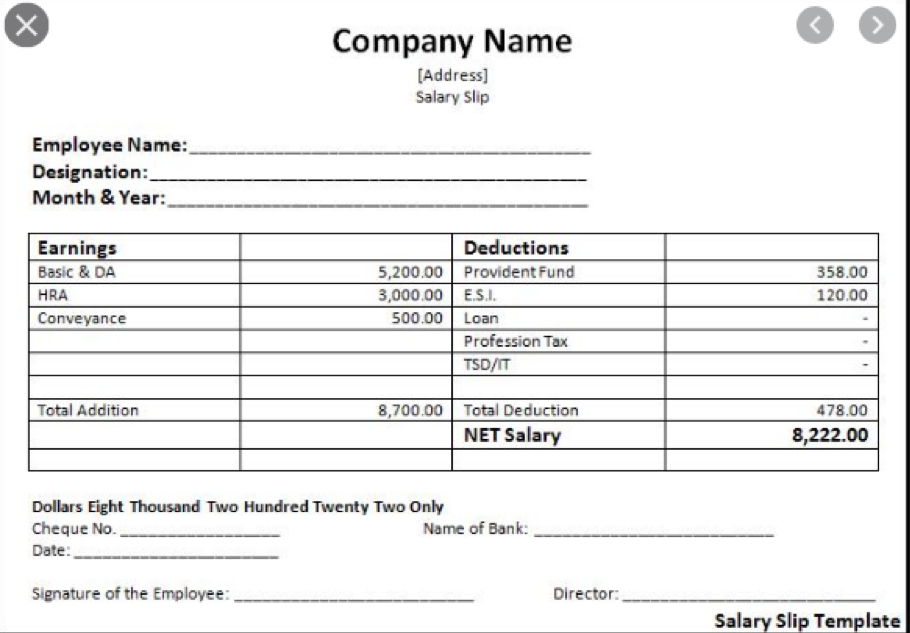

Example of Salary Slip

Below is a sample of the salary slip. We have picked a template from Google, and you can search for more similar templates.

What are the Different Components of Salary Slip?

There are many different components in the salary slip. These are majorly divided into Income and Deductions. There are sub-components to these two components, and we have shared more information below. It should be noted that we have only listed a few of these components. In actual, there can be more, and they can vary from one company to another.

Income – Below are the components of the income/earnings.

- Basic Salary – This portion is usually around 40% of your total salary. The other components of the salary are based on the basic salary. Some of the benefits that you receive are also dependent on Basic Salary.

- HRA – HRA is referred to as House Rent Allowance, and it is the amount that is allocated to people to pay their rents. The companies offer 40$ to 50% of the basic pay as HRA. You can claim the tax deductions for the rent you pay, but it is restricted to the rented accommodation only.

- DA – DA is known as Dearness Allowance, and this is also calculated on your basic pay. This component is added to the salary to offset the impact of inflation on your salary. This section is taxable, and it is mostly found on the salary slips of the government employees.

- Special Allowance – Some companies offer performance-based incentives. Such earnings are parked under the category of special allowance. If you are working in marketing agencies, then the commissioned earned from the sales are also a part of a special allowance.

- Overtime Payments – Some of the companies offer the payment to their employees for the overtime filed. All the overtime payments are parked under this category, and it is also a taxable component.

- Week-off Allowance – Here is another type of categorization available for some employees. If your scope of work doesn’t include working on a weekend but if you worked on a weekend for a deliverable, then it will be added under Week-Off Allowance.

- Night Shift Allowance – Some of the companies often provide you with an allowance to work in night shift. This allowance is calculated on per day basis.

- Telephone and Internet Allowance – Some of the companies also offer telephone allowance to their employees. The internet allowance is a common component if you work in the IT industry.

- Other Allowance – Any additional allowance which can’t be categorized in the above components may be paid to the employee via other benefits. This is a broader category that you can use.

- Meal Allowance – Some of the companies offer meal allowance to their employees. This benefit may even be provided in the form of Sodexo. The advantage of the meal allowance is that it helps you in saving the tax.

Also Read: Best ULIP Plans in India

Salary Slip Deductions

Below are the components of the deductions.

- EPF – This is known as Employee Provident Fund, and the deductions under this component are usually 12% of the basic salary. Some of the people may choose to increase their EPF contribution, which will lead to higher contribution. This is a tax-deductible component.

- Professional Tax – Some states charge professional taxes on the people working in the state.

- Tax Deductions – These are the tax deduction at the source, and this deduction is deposited to the income tax department on your behalf. The tax is deducted at the source, and you can lower this deduction by investing your money in tax saving components.

What is Standard Deduction and How Does it Impacts Salary Slip?

During the union budget session of 2019-2019, the honourable Finance Minister Arun Jaitley introduced standard deductions. During the session, a standard deduction of Rs 40,000 was proposed, and the employees can claim the standard deduction. This amount was increased to Rs 50,000 in the upcoming session. The standard deduction reduces the net taxable income. The transport allowance and the medical allowance has been removed, and in return, the standard deduction has been added.

Earlier, you had to submit the medical bills and travel bills to claim the deductions in the taxable amount. Some of the companies even used to offer a reimbursement of medical allowance after you submitted the invoices. Things got easy for the employees after the introduction of the standard deductions. There is no need to provide all that documentation, and it has become effortless to claim these tax deductions.

How Can You Increase In—Hand by Just Knowing Salary Slip?

Salary slip has the details of all the components in it. It tells you about the HRA, DA, LTA and all such components that you need to be aware of to save the tax. Some of the organizations offer you an option to change the components of the salary or tweak them to maximize your salary savings. This knowledge helps you in planning your investments and expenses in a better way. You will be able to claim the deductions, and you will also be able to save yourself from paying a lot of taxes.

This way, you can choose the right set of investments for yourself. So, you can increase your monthly take away if you understand your salary slip in a better way. You must always pay attention to the various components of the salary slip to decrease your tax liability.

Also Read: National Pension Scheme (NPS): Features & Benefits

What is the Difference between CTC and Fixed Compensation?

When the people join the job for the first time, they may get carried away by the CTC offered to them. When they receive their first paycheck, they get the shock of their lifetime. This shock is mainly because of the difference between the CTC and the Fixed Compensation. The CTC is the cost to the company, and it is defined as the sum of fixed pay, Pension, PF contribution and other allowances. Some of the companies may even include the employer contribution towards PF in the CTC. Whereas, the in-hand salary is what an employee receives after all the deductions. Whenever you are applying for a job, ensure that you check the difference between the CTC and in-hand. You must also check the components included in CTC. Checking this will help you in understanding what you will get every month.

What are the Taxable and Non Taxable Components of Salary Slip?

All the components are not fully taxable. Some of the components of the salary slip are non-taxable or partially taxable as well. You can check out the details below, and this will help you in maximizing the tax deductions that you claim.

| Components | Taxable / Non-taxable / Partially Taxable |

| Allowances paid to retired members of UPSC | Non-taxable |

| Allowances paid to the government employees living abroad | Non-taxable |

| Allowances paid to the Supreme and High Court judges | Non-taxable |

| Allowances paid to UNO employees | Non-taxable |

| Basic Pay | Fully-taxable |

| CCA City Compensatory Allowance | Fully Taxable |

| Conveyance Allowance | Partially Taxable |

| DA – Dearness Allowance | Fully-taxable |

| HRA – House Rent Allowance | Partially Taxable |

| Leave Travel Allowance | Partially Taxable |

| Meals Allowance | Fully Taxable |

| Medical Allowance | Partially Taxable |

| Other Allowances | Fully Taxable |

| Performance Allowance | Fully Taxable |

| Special Allowance | Fully Taxable |

By going through this table, you will also be able to tweak your salary to get the maximum deductions while filing income tax.

How to Download Salary Slip Online?

Many websites offer you with the template for the salary slip. It is effortless to create a salary slip online. Check out the steps below.

- You can start by downloading the format of the Salary Slip. It is better to download an excel format as it will be easier to edit.

- Now, enter the name of your organization and enter other details like the month and company address.

- You can then add the name of the employee, employee id, designation etc. Also, enter the PAN Details for yourself and the employee.

- Now, add the details of the salary components. You must also add the details of the salary deductions.

- You can now save the file and publish it for the employee with an e-signature, or you can print the file, stamp it and give it to the employee. While giving the digital copy, ensure that you provide the pdf copy.

What is the Importance of Salary Slip?

There are many things that the salary slip is used for. Below are some of the points that make it one of the most important documents for you.

- Tax Planning – The salary slip gives you information about all the components of the salary. This component includes the LTA, HRA, Basic Salary and other such details. It also tells you about the deductions that are already happening. Knowing these components would help you in tax and investment planning. This way, you will be able to minimize the tax that you are paying and maximizing the savings.

- Availing Loans and Other Services – Whenever you apply for a loan or a credit card, you will be asked to provide your salary slip. Based on the salary slip, the eligibility of the loan is decided. Your credit score is checked, but the salary slips are an essential component of the application process.

- Seeking Employment – When you are seeking employment, you will need the salary slip. The salary slip provides a base to the new employer for negotiating the salary. It gives the details of the fixed and variable component of your salary as well. Moreover, the salary slip helps you in proving the designation and tenure at an organization as well.

- Document Proof of Income – In some cases, you are required to prove your employment and income. The salary slip may even be necessary when you apply for executive programs at universities, visas and other such things.

This was all about the salary slip. We have covered a majority of questions about the salary slip. We understand that you might have some more questions about the salary slip. You can write back to us, and we will answer those questions about the salary slip. We are sure that it will help you in better tax planning. You will pay less of tax, and you will be able to build an investment pool you’re your retirement.