How To Make EDMC Property Tax Online Payment?

Property taxes add up to a significant proportion of the municipal budget that is essential to maintain and provide basic civic services to the general population of a state, city, or union territory. And just a few years ago, there was no other option for people to physically visit the local municipal office and pay the tax amount, thus it seemed like a hectic task. However, things have changed quite a lot since digitalization started in India. Now many municipal corporations across the nation have utilized online portals to collect property taxes from the general population. And the same is done by MCD in Delhi, now paying for SDMC, NDMC, and EDMC property taxes has become incredibly straightforward. Because people still face issues since it is a fairly new implementation, thus we are here with a detailed guide on how to make EDMC property tax online payments.

What Is MCD Property Tax?

EDMC stands for East Delhi Municipal Corporation, which falls under MCD or Municipal Corporation Of Delhi. So, if your property is situated in the east of Delhi, then you must pay the EDMC tax which will eventually be utilized to provide basic civic services in the east Delhi areas.

How To Pay EDMC Property Tax Online?

Online portals like MCD have made it super easy for the people of Delhi to pay property taxes without even needing to visit the local municipal office. Let’s take a look at the step-by-step process of how to pay EDMC property tax online.

- Open a browser on your device, type the term “EDMC Property Tax” in the search bar, and hit enter. Now click on the very first search result, which would be the official website of EDMC. Or you can visit this URL https://mcdonline.nic.in/edmcportal/service to directly land on the official online portal.

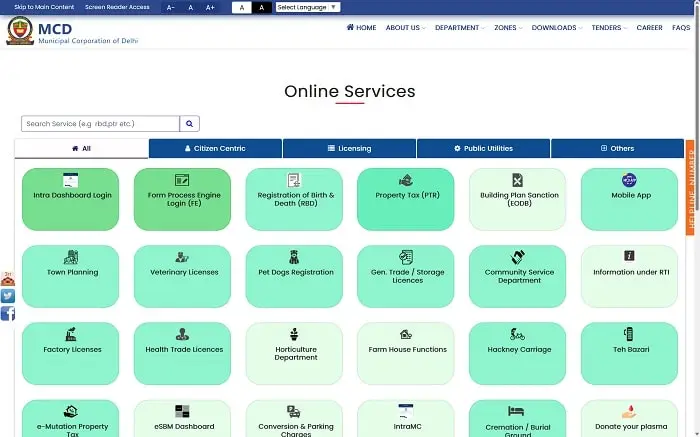

- On this page, you’ll see dozens of different options listed under the Online Services On the very top, you’d find an option named “Property Tax (PTR).” Just hover over that option and it’ll reveal two other links, simply click on the Citizen Login link.

- Another tab will load on your browser, where you’ll need to log in using your login credentials, or you can log in using OTP verification from your registered mobile number.

- Once you are logged into your citizen account, you’ll directly land on the dashboard of the EDMC portal, where all your properties will be listed. There will be an “Actions” button at the very right hand side of the listed properties rows.

- Click on the “Actions” button, and it’ll reveal some other options on the screen like a drop-down menu, find and select the “Pay Tax” option to proceed next.

- Once you do that, a pop-up will appear on the screen asking you to select the financial year for the property tax you want to pay. Select the correct financial year, and hit the Submit button.

- Now the EDMC database will fetch the payable tax details of your registered property and you’ll be able to see all the details on your screen. On this page, you don’t need to edit anything, simply scroll down to the bottom of the page, and hit the “Pay Tax” button.

- Next, the online payments page will load on your browser, where you’ll see the total payable tax amount and some payment getaways to choose from. Select any of your preferred payment gateway to proceed next and complete the transaction.

This is how you pay EDMC property tax online without leaving the comfort of your home. After a successful transaction, the success message will be prompted on the payment merchant’s website, and then you’ll be automatically redirected to the EDMC portal. This time, you’ll see a success message on the EDMC portal as well along with the transaction ID, and a few other details.

How To Download the EDMC Property Tax Receipt?

If you want to download the EDMC property tax receipt that you have just paid up, then after the success message prompted on the EDMC portal, you’ll for sure have a link under that message like “Download Receipt,” click this link to download the receipt of the transaction you have just completed. Or if you want to get your hands on the old property tax receipts from previous financial years, then just head over to the EDMC portal homepage, log in using your login credentials or OTP verification, and hover over the “Property Tax (PTR)” option and choose the “Receipts” link this time. A new tab will open in your browser and on this page, just enter the Property Ref Id (UPIC) and the Financial Year, and hit the Submit button. That is it, now the database will load the receipt of that financial year on your screen, and there you’ll have the Download Receipt button to save the property tax receipt as a PDF document to your device.