How To Make BBMP Property Tax Online Payment?

Before digitalization started in India, people used to pay taxes like BBMP Property Tax by going to the physical branch of BBMP. Now, there’s a way to pay BBMP property tax online from the comfort of your home. But many people don’t know how to use the online portal of BBMP property tax or they are a little confused about whether it is safe or not. Don’t you worry now, today we will be going over everything you need to know about paying the BBMP property tax online. So let’s get down to it then.

What Is BBMP Property Tax?

BBMP’s full form is Bruhat Bengaluru Mahanagara Palike, which is a municipal body working under the state government. And every person who owns property in Bengaluru has to pay property taxes to the government through BBMP. And property owners have to pay such taxes annually. These taxes are used to provide upgrades and civil facilities to the general population of Bengaluru.

How To Pay BBMP Property Tax Online?

A few years ago, paying property tax was a hectic task since you had to visit the physical branch of BBMP, but now you can do the same thing without leaving your couch. Let’s talk about the process of paying BBMP Property Tax online using the BBMP online portal.

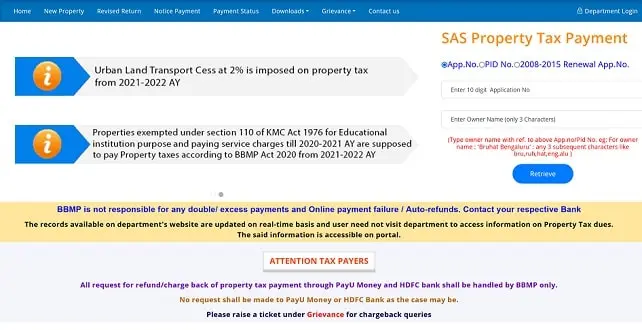

- First things first, open a browser on your smartphone or computer device. And search for the term “BBMP Property Tax,” and select the very first option that appears at the top of the search results. Or just visit this link, https://bbmptax.karnataka.gov.in/

- Once you are at the homepage of the BBMP Property Tax portal, there will be a form on the right-hand side of the screen that says “SAS Property Tax Payment.” Enter the required details such as your 10-digit application number, and the first three characters of the property owner’s name. And proceed next by clicking on the “Retrieve” button.

- Now the portal will fetch the details of the application number submitted, and you’ll be able to see the property owner’s details on the screen. Like there will be the property owner’s name, phone number, payable tax years, etc.

- If the detail shown on the screen is correct, press the proceed button to go to the next step. If there are any penalty charges for paying tax after the due year, then you’ll be able to see those charges by scrolling down a little on the same page.

- After clicking on the proceed button, you’ll land on the page where all the information regarding the property taxpayer will be shown. If there are any details that need to be updated or entered, then they’ll highlight in red. When you scroll down on the very same page, there will be a total breakdown of the payable amount as BBMP property tax.

- Below the property owner’s details, there will be two buttons, “Challan Payment” and “Online Payment.” Click on the blue button that says “Online Payment” in order to pay your taxes online.

- Now you’ll receive an OTP on your registered mobile number, and after the OTP verification, you’ll be able to choose the online payment method to pay the taxes. There are payment methods like UPI, Credit Card, Debit Card, Wallets, and Net Banking available. You can pay by whichever method you like.

That’s it. This is how you pay BBMP property tax online.

How To Check The Dues And Payment Status Of BBMP Property Tax?

Checking the dues and payment status of your BBMP property tax is quite easy and straightforward.

- For that, just head over to the homepage of the BBMP Property Tax online portal. Use this link https://bbmptax.karnataka.gov.in/

- Now, select the option “Payment Status” from the main menu of the portal. Once you do that, you’ll land on another page, where you’ll be asked to submit the application number or the Challan transaction number. If you have paid taxes offline by going to the physical branch, you can enter the transaction number to find out the status of your payment.

- After entering the application number or Challan or transaction number, simply click on the Retrieve button. Now the database will fetch the payment status and dues related to your application number.

How To Download the BBMP Property Tax Receipt?

You can download the BBMP property tax receipt when you have just paid the taxes using the online method because there will be an option to download the receipt. However, you can simply head over to the official web portal of BBMP Property Tax, and select the Receipt Print option from the Download drop-down menu. When the next page loads, you will be asked to select the assessment year, and 10-digit application number. Provide the necessary details, fill out the captcha, and hit the submit button. That’s it, now your receipt will be shown on the screen, you can print it out or save it as a PDF document to your device.