How Much Does It Cost to Create A Consumer-focused Fintech App?

Fintech apps offer both consumers and companies a range of business opportunities. The financial technology/FinTech industry, which combines technology and financial services, has experienced rapid growth in recent years. Many businesses are therefore looking for ways to enter this growing market.

To enter this growing market, you need to understand consumer demands. Consumer-focused fintech has seen a lot of changes over the years.

If you’re looking for information on how to create a consumer-focused FinTech mobile app, you’ve come to the right place. From developing your app concept to the type and cost of development, everything you need to know is covered in this blog.

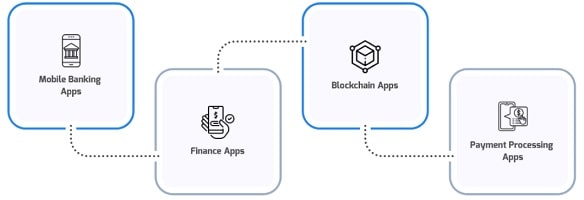

Types of FinTech Mobile Apps

There are a number of fintech applications on the market. Some of the most popular types you might want to think about creating are listed below:

1. Mobile Banking Apps

Users can manage a variety of banking-related tasks from their mobile devices with the help of mobile banking apps. Transferring money, paying bills, sending invoices, and keeping track of expenses are some frequent mobile banking tasks.

2. Finance Apps

For the average consumer, financial apps make tasks like investing more convenient.

Finance apps allow users to manage investments and trade stocks from their smartphones or tablets. Numerous finance apps also help users apply for loans, open new savings accounts, and find answers to common financial queries.

3. Blockchain Apps

Users can conveniently and effectively buy and sell different cryptocurrencies using blockchain apps. These tools help crypto investors manage their money while on the go and provide a high level of security.

4. Payment Processing Apps

Applications for payment processing make it simpler for vendors to accept payments from clients. These payment processors typically accept bank transfers, credit and debit card payments, as well as occasionally cryptocurrency payments.

You may hire a leading fintech and fitness app development company like “Quytech” to get your job done easily and with no hassle.

Things to do Before Investing in Fintech Applications

The best feature-aligned solutions must be included when offering the user the best stack of services. Always make an effort to guarantee that your app has the best features and complies with industry standards. There are many other parameters that you need to consider and ensure before investing in a fintech app.

1. Study the Market

You should study your clients, both existing and potential ones, and understand their needs. For this, research your target audience and study similar solutions that already exist.

In addition, studying your competitors helps understand what you can offer to people. It can be complex solutions, unique ideas, advanced services, or other competitive advantages.

2. Research for Fintech Mobile App Development

Make sure to do your research on the legal specifications your app must meet before you start your project. They differ significantly between nations, and frequently even between states and regions. In the nation for which your product was designed, financial apps must abide by a number of data privacy laws, such as GDPR, ePrivacy, CCPA, and others.

The following guidelines and frameworks should be adhered to by modern solutions:

- PCI DSS (Payment Card Industry Data Security Standard);

- AML (Anti-Money Laundering) Regulations;

- KYC (Know Your Customer) Compliance;

- Digital Signature Certificates (DSC), etc.

There are numerous additional requirements, which vary from nation to nation.

How to Create a Fintech App: Technical Solutions

Working with a fintech app development company is possible as soon as your intentions and goals are crystal clear and you are knowledgeable about the particulars of the local legal system. With the aid of professionals, you can choose the best technological solutions and a technology stack.

Mobile Application Types

Depending on the features of the solution, you can choose one of the following app types:

Native- Such applications are developed considering all the peculiarities and UX recommendations of the chosen OS. Native app solutions provide maximum security and have access to phone cameras, GPS, contacts, etc. The fintech software creation cost of this type is the highest because, for each operating system, you will have to build a product from scratch.

Cross-platform: An all-purpose program that can be set up on any operating system. Has a small number of features but is profitable in terms of time and money spent on development. Most of the time, it’s just a user-friendly interface, and the server handles all the actions.

You may hire a leading fintech and healthcare app development company like “Quytech” to get your job done easily and with no hassle.

Progressive web apps- such apps are the simplest solutions and are extensions of a certain web service. Licenses for application stores don’t need to be purchased because they can be quickly and easily downloaded. With these tools, all operations are carried out on the website; the app merely acts as a shortcut and a user interface tailored to a particular device.

How Much Does It Cost to Build a consumer-focused Fintech App?

We have touched upon the main factors that should be taken into account when making a financial app for consumers. Each of them has an impact on the final development cost.

There are many factors on which the price of a finance application may vary but we have gone through a few major subjects to identify for you how much would it cost for you to create a consumer-focused fintech app. The final budget of the app is influenced by the following factors:

- Set of features;

- Platform choice (App type and OS);

- Complexity;

- Development team rate;

- Legal regulations, and more

The final cost, for instance, will be somewhere between $50,000 and $200,000. The cost of the most complicated apps could end up going up. A basic fintech app with an easy-to-use user interface can cost around $40,000. Additionally, depending on the tasks assigned, the cost of developing a sophisticated app with cutting-edge functionality will range from $50,000 to more.

Conclusion

Each type of business is distinct and has a different set of goals, so there isn’t a single fintech app that could meet their needs. Costs are also impacted by the various fintech application types.

As a result, the price to create a consumer-focused fintech app will depend on the project’s features, nature, and level of difficulty.

However, every client should have a general idea of the cost and time involved in developing the required app. Custom fintech app development typically costs $50,000 to $200,000 on average. However, the exact figure depends on many factors.

If you’re looking for the best fintech app development company and want to convert your ideas into reality then hire “Quytech”.