5 Best SIP Plan to Invest in India

We all are aware of the fact that savings are an important aspect of our life that is required for effective wealth creation. A SIP plan is a systematic investment that helps you invest a small amount of money each month in a mutual fund. These funds can further invest your money in equity, debt, or other financial instruments. Today, several fund houses provide you with a SIP plan.

The following is the list of the best SIP plans that you can invest in:

1. ICICI Prudential Bluechip Equity Fund

If you are looking for long-term investments, the ICICI Prudential Bluechip equity fund is one of the best SIP funds in India today. The minimum investment required for the fund is only Rs. 1,000. This fund, as the name suggests, mainly invests your amount in bluechip companies. Hence, it is one of the most trusted mutual funds. This SIP plan should be on your list of investments if you are seeking opportunities for retirement planning and wealth creation. The SIP plan has been performing consistently well, particularly in the long term.

2. Axis Bluechip Fund

Keeping aside a small amount of money each month for investment in this fund can go a long way in helping you get a secure future. This equity fund boasts of a 7.53% return when invested for three years and a 5.92% return when you remain invested for five years. The main aim of this plan is to help you in diversifying your assets in the long run. The fund is known to invest in different types of securities. This, in turn, means that your risk is distributed and you end up maximizing your returns.

3. Aditya Birla Sun Life Regular Savings Fund

Next is the Aditya Birla Sun Life Fund. If you are willing to take some amount of risk when it comes to investments, then this is one of your best bets. As per experts, you should invest in the fund if you are willing to keep making investments for a period of one to three years. The fund does well as far as diversification is concerned. There is a good mix of both equity and debt instruments. This means that a certain portion of the investment is guaranteed.

4. Motilal Oswal Multicap 35 Growth Fund

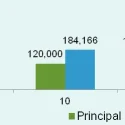

If you are willing to invest around Rs. 10,000 per month in a mutual fund plan, then the SIP fund by Motilal Oswal is one of the best in the market today. Although the minimum investment required is only Rs. 500 per month, investing at least Rs. 10,000 is important for long-term gains. The fund provides a good mix of investments in different types of stocks including large-cap, mid-cap, and small-cap stocks. Most of the stocks invested are in only the Indian companies.

5. HDFC Balanced Advantage Fund

The term balanced fund implies that the fund has an equal proportionate of investment in equity as well as debt. Thus, if you are not willing to take too much risk, then this can be a good option for you. The best part about the fund is that there is no minimum lock-in period as such. You can start investing in this SIP with a minimum of Rs. 5,000. Thereafter, each month you can invest Rs. 1,000. The fund that started its operation since the year 2000 is one of the best SIP plans that India today has.

Thus, as seen above there is no dearth of choices when it comes to making investments in SIP. A SIP plan is one of the best investments to start early on as it requires minimum investments each month.