Benefits of Investing in the Best SIP Mutual Funds

Some individuals may think investing in SIP mutual funds may involve high risk with huge initial investment money. Mutual funds are in several variants, and one can choose it as on investment objective, investment horizon, and the chance of risks. Moreover, it doesn’t require a huge investment. This is possible in a systematic investment plan or SIP. This is an excellent mode to invest in mutual funds gradually.

If you are wondering about the best mutual funds for sip, the following benefits can help you plan strategically to get suitable returns.

How will the SIP mutual fund work?

When investing through SIP, you invest fixed money for a given period. The amount lets you purchase certain fund units. If you can continue with the investment for a specific time, you can invest in mutual funds during the market’s highs and lows. The return on the investment is impacted by the prevailing market conditions. So, you have to take the right decision that can help get better yields in a given time. Market timing is about knowing the risky proposition and do not invest at the wrong time. This is where SIP can remove the factor of unpredictability.

If you are sure of the investment tenure and its frequency, you can easily automate the investment and decide accordingly for the money you want to spend. You have to decide on a standing instruction to the bank to transfer the money from your linked bank account into the SIP mutual funds on a fixed date monthly.

How do you invest in SIP?

Start by identifying your financial goals, select a suitable mutual fund option, and get in touch with a financial institution for further guidance on investing in SIP through mutual funds. Start investing only when your research is complete. You should be well informed about the investment option you opt for.

Why invest in mutual funds through SIPs?

There are some benefits to choosing to invest in mutual funds through SIPs:

Do Not Demand a Huge Initial Deposit

If you are planning to invest in mutual funds with a limited deposit, a SIP mutual fund is the best option. It requires depositing only 500 rupees monthly. It is an affordable investment option, and you don’t have to invest huge initial capital. It allows you to increase the SIP as per convenience. So, if you get a hike, you can plan to invest more monthly for the SIP. This is how it becomes easy to manage your investment and plan for better savings.

Power of Compound returns

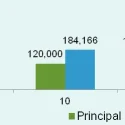

The returns you look for on an accrued return are known to be compounding returns. These are suitable to help small investors grow and accumulate savings in a long-term process. To drive maximum benefit, start early to get reasonable returns calculated on compound interest through SIP with the help of calculators on the financial sites.

Flexible investment option

If you want to invest in a mutual fund, start through SIP with just a minimum of 500 rupees monthly. If you are a salaried person, select the date of the SIP transfer as per the salary date when you have a sufficient amount in your account. It will ensure that the SIP instalment transfer will not bounce. Try to invest in a properly phased manner for suitable returns and maintain the investment for a long time.

Rupee cost averaging

When investing in an equity mutual fund through SIP, you have to invest a fixed amount regularly, across different market levels. You don’t have to worry about the market cycles and the time for investment. It will help buy more units as per the market fluctuations.

So, SIP is the way to average the price of equity units over time. It can lessen the impact of any short-term fluctuation depending on the investment you make in the market. When the market is extremely volatile, one can benefit from rupee cost averaging and get high returns as the market starts recovering.

Promise high returns

Professional fund managers are responsible for taking charge of mutual fund investing in tracking records. It is to work towards generating optimum returns from the investment with the correct research and market analysis.

Even when investing a small amount via SIP, you can reap suitable long-term returns with the help of a professional management team. SIP is a carefully selected mutual fund that yields higher returns than conventional investments such as PPFs, recurring deposits, etc. It also always tax deduction in this form of investment up to 1.5 lakhs.