Choosing the Optimal Mutual Funds to Align with Your Investment Goals and Risk Tolerance

When it comes to investing your hard-earned money, the realm of mutual funds has captured the attention of numerous individuals seeking to grow their wealth. The allure of mutual funds lies in their unparalleled ability to diversify your investment portfolio and cater to your specific financial objectives and tolerance for risk. In this article, we shall delve into the vast expanse of mutual funds, exploring the manifold benefits they proffer and elucidating the ways in which you can meticulously handpick the most fitting ones to harmonize with your fiscal aspirations.

Decoding the Essence of Mutual Funds

Mutual funds, at their very core, function as investment vehicles that judiciously pool capital from multiple investors, with the intention of being allocated to a myriad of assets, including stocks, bonds, and commodities. These financial instruments are entrusted to seasoned fund managers who diligently analyze market trends and astutely make investment decisions on behalf of the investors. This affords even the most novice investors an opportunity to gain exposure to a diverse array of asset classes without necessitating a profound understanding of the labyrinthine financial markets.

## Tailoring Investments to Match Your Objectives

The primary stride toward selecting the crème de la crème of mutual funds entails a meticulous evaluation of your investment goals. Do you yearn for prolonged growth or a steady stream of income? Do you harbor a specific timeline for achieving your financial milestones? Thoroughly comprehending your objectives shall facilitate the identification of the mutual funds that seamlessly align with your grand ambitions.

For those in pursuit of long-term growth, the domain of equity mutual funds beckons enticingly. These funds predominantly deploy capital into stocks, thereby harboring the potential for more substantial returns, albeit accompanied by a heightened degree of risk. On the flip side, if your focus pivots towards the cultivation of a steady income and safeguarding your capital, debt mutual funds shall emerge as a more suitable option. These funds channel their investments into fixed-income securities, such as bonds and treasury bills, which are renowned for their stability. Ascertaining the optimal mutual funds is contingent upon a nuanced understanding of your financial aspirations.

## Assessing Your Appetite for Risk

The inescapable factor of risk tolerance plays a pivotal role in discerning the mutual funds that shall seamlessly assimilate with your investment strategy. Each individual’s tolerance for risk diverges, with some being amenable to venturing into uncharted territories, while others prefer to adopt a more conservative stance. It is imperative to gauge your propensity for risk prior to embarking on your investment journey.

Equity mutual funds, by their very nature, are considered to harbor a greater degree of risk due to their substantial exposure to the volatile stock market. Within the realm of equity funds, a nuanced classification emerges, encompassing large-cap, mid-cap, and small-cap funds. Large-cap funds selectively invest in well-established companies, whereas mid-cap and small-cap funds seek out medium-sized and emerging enterprises, respectively. As a general rule of thumb, smaller companies tend to exhibit higher levels of risk, albeit accompanied by the tantalizing prospect of remarkable growth.

For those endowed with a more conservative outlook, debt mutual funds proffer a sanctuary of stability. These funds adroitly invest in fixed-income securities, which offer a predictable income stream and are characterized by lesser volatility than their equity counterparts. Within the domain of debt mutual funds, a plenitude of subcategories exists, including liquid funds, short-term funds, and long-term funds. Each subcategory delineates its investment horizon and corresponds to varying levels of risk.

## Unleashing the Power of Online Mutual Fund Investing

In our contemporary digital era, the advent of online platforms has rendered investing in mutual funds an endeavor of unparalleled convenience. The rapid proliferation of online investment platforms, furnished by esteemed banks, mutual fund companies, and brokerage firms, has ushered in a new era of accessibility for investors. Such platforms empower individuals to seamlessly navigate the intricacies of mutual fund investing, with the entire process merely a few clicks away.

To commence your online investment odyssey, it is essential to cherry-pick a reliable platform that resonates with your needs and provides a comprehensive suite of investment options. Numerous online platforms facilitate the purchase and sale of mutual funds, empowering investors with unparalleled flexibility. The initial step encompasses the completion of a registration process, entailing the submission of necessary documents, such as KYC (Know Your Customer) documentation and pertinent bank account details. Once this prerequisite has been fulfilled, a world of investment possibilities unfurls before you.

## Leveraging the Mutual Fund Calculator: Unveiling Invaluable Insights

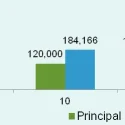

In your quest to identify the optimal mutual funds, the judicious utilization of a mutual fund calculator can serve as a beacon of enlightenment. These sophisticated tools empower you to assess the past performance and risk metrics of various mutual funds, thereby enabling you to make informed investment decisions. By juxtaposing and scrutinizing the performance of different funds, you shall acquire invaluable insights into their historical returns, volatility, and risk-adjusted metrics. This shall ultimately pave the way toward unraveling the mutual funds that impeccably align with your investment objectives and risk appetite.

## Embrace the Realm of Mutual Funds

Mutual funds, with their unparalleled ability to diversify your investment portfolio, cater to your financial objectives, and navigate the complex world of finance on your behalf, are undoubtedly a captivating investment avenue. Embarking on this financial odyssey necessitates a nuanced understanding of your investment goals, risk tolerance, and the potential of online platforms and calculators. With a meticulous and informed approach, you shall be well-equipped to navigate the labyrinthine world of mutual fund investing, transcending the realms of financial mediocrity and propelling yourself toward fiscal prosperity.