Choosing the Best Option Trading Platform for Successful Trading

Options trading is a famous derivative instrument among traders. While rewarding, its success depends on various factors, such as the chosen platform.

However, with numerous options for traders, choosing the best option trading platform can be difficult. To help you with the same, let’s delve deeper and understand how to choose the best platform for option trading.

How to Choose the Best Option Trading Platform?

When choosing the best option trading platform, several factors need careful consideration to ensure a successful trading experience as mentioned below.

1. User Interface and Experience

A user-friendly interface contributes significantly to successful option trading. A well-designed platform with clear navigation, real-time data updates, and customizable dashboards improves the trading experience.

Mobile compatibility is also important for traders who need flexibility and on-the-go access. Also, to ensure a safer experience, checking the security of the platform is crucial.

For this, check that the platform you are choosing has security measures in place, including encryption, two-factor authentication, and compliance with regulations.

2. Technical Analysis Tools

Technical analysis tools are helpful for traders in their decision-making process. Thus ensure that the trading platform you choose offers charting tools, indicators, drawing tools, and Option Greek calculators.

These tools help option traders analyze market trends, identify support and resistance levels, and assess potential risks and rewards.

3. Readymade Options Trading Strategies and Strategy Builder

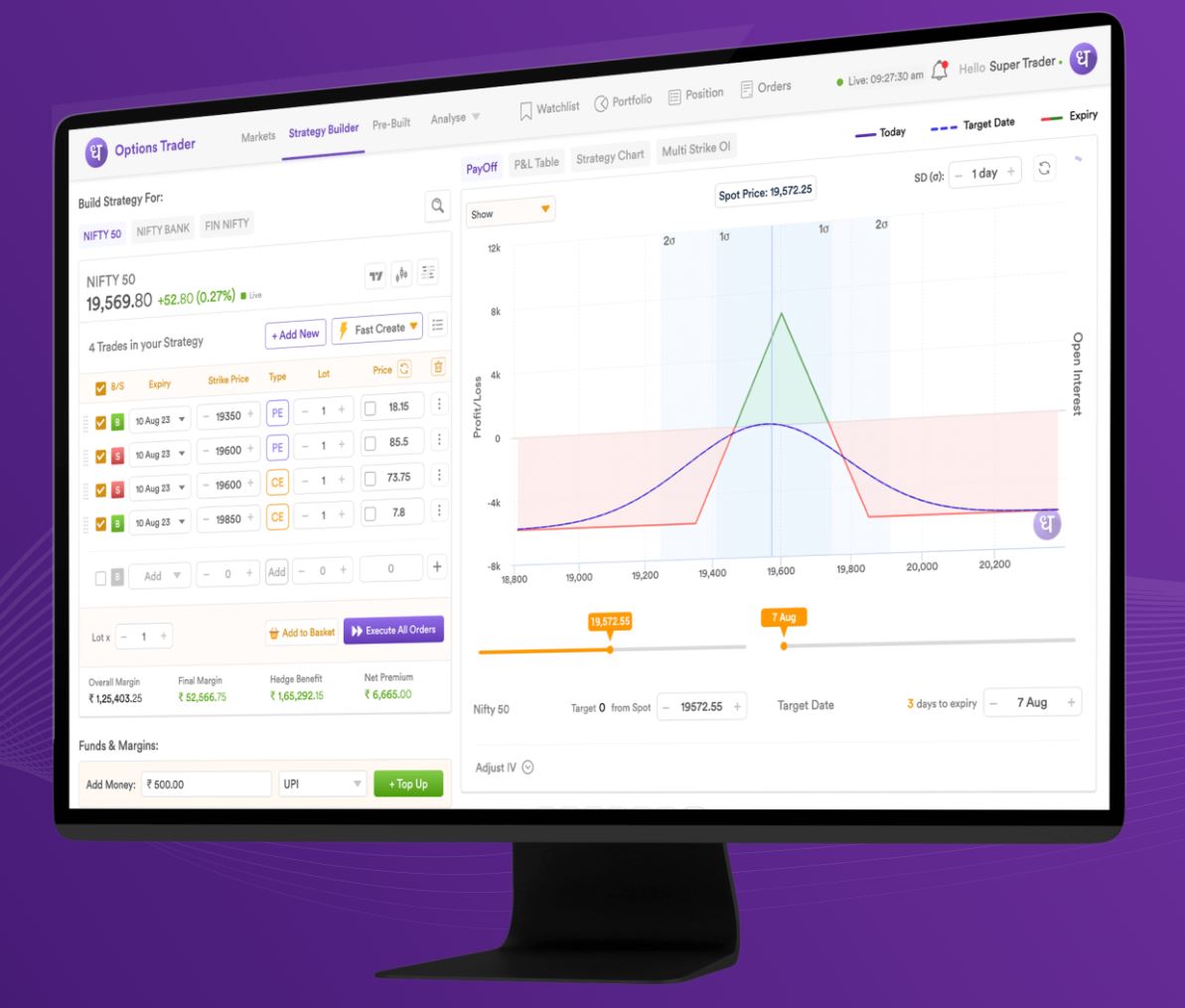

Nowadays, trading platforms like Dhan offer readymade option trading strategies such as covered calls, iron condors, straddles, and vertical spreads, from basic to advanced, helping traders tailor their approaches depending on market conditions.

Dhan also offers a custom strategy builder. This tool allows you to create, test, and use unique trading strategies based on the market conditions and your trading preferences.

4. F&O Screener

A Futures and Options aka F&O screener is essential for identifying trading opportunities. This tool should provide real-time data and filtering options to pinpoint contracts that align with your strategy and risk profile.

The platform you chose should offer features like sorting by volume, open interest, volatility, and other important metrics to assist traders in making informed decisions.

5. Risk Management Features

Effective risk management features are essential for protecting your funds. Platforms like Dhan that provide features like stop-loss orders, limit orders, and conditional orders help you manage risk by automating entry and exit points.

6. Check Fee Structure and Customer Support

Transparent fee structures are essential. You should check the costs associated with trading options, including commissions, contract fees, and other charges. A platform that offers competitive pricing without hidden fees is an ideal one.

Along with that, you should also have access to support channels for technical issues, account inquiries, and trading assistance. Live chat, email, and phone support should always be available, especially during trading hours.

Conclusion

Choosing the best option trading platform requires proper and careful consideration of the factors mentioned in this article. As a trader, you should prioritize choosing a reputable platform like Dhan for options trading to leverage technical tools, custom strategy builder, and much more.